You have been searching the Calgary MLS and you have found the perfect home and you have applied for a mortgage loan, now what? For many homebuyers, the time between applying for a loan and waiting to find out if the loan has been approved is an excruciating experience. To help ease your anxiety, it is helpful to learn more about the types of things that are taken into consideration by lenders when trying to decide whether or not they should approve your loan. One of these many factors is your credit score, but what exactly is your credit score and how is it calculated?

What is a Credit Score?

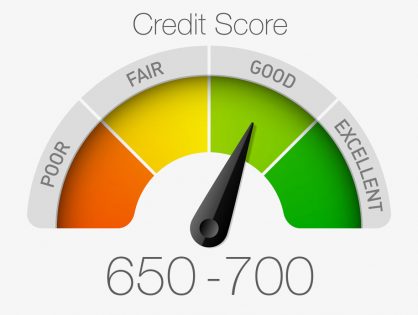

Your credit score is a number that is assigned to you based on your financial health at any given time. This figure, which is calculated by Equifax and TransUnion on a 300 to 900 scale, is then used by lenders to determine the risk of providing you with a loan in comparison to other borrowers. The higher your credit score, the less of a risk you are considered to be. The exact algorithm used by the credit-reporting agencies to determine your credit score is not made public. Furthermore, some lenders use these scores as only one guideline and may, in fact, have their own way of determining a credit score for each potential borrower.

What is Used When Determining a Credit Score?

While the exact algorithm is unknown, the following pieces of information are used when calculating credit scores:

- Payment history

- Account history

- Collections or bankruptcies recorded against you

- Outstanding debts

- The number of recent inquiries into your credit report

- The type of credit you use (i.e. credit cards, loans or a combination of the two)

Each of these factors is assigned a different weight in determining your final score. Your payment history, whether or not you have filed for bankruptcy and your outstanding balances are the most important elements considered when determining your score.

How Can I Improve My Credit Score

The quickest and easiest way to improve your score is to be sure to pay your bills on time, to avoid bankruptcy and to keep your outstanding balances low. While it is a good idea to use your credit cards regularly, you should aim to keep your balances below 35 percent of the available limit on each card. Since having a high amount of revolving credit can have a negative impact on your credit score, you may want to consider closing a couple credit cards if you have several cards. At the same time, be careful when closing accounts, as closing too many accounts at one time or closing accounts with a long credit history can actually have a negative impact on your score.