When you get involved with stock trading for the first time, you’ll quickly discover that one of the biggest challenges in the market is deciding which stock you should be investing in. There are thousands of stocks listed on the market today, and the number of available options grows every day. However, as we all know, not all shares are equal. Some will be far more lucrative to you and your investment plan than others. The trick is figuring out how you can separate the winners, from the stocks that are just going to waste your time and your money. One of the easiest ways to filter out your choices without spending days at a time on the internet is to use a stock screening solution like the Finviz Screener.

What is a Stock Screener?

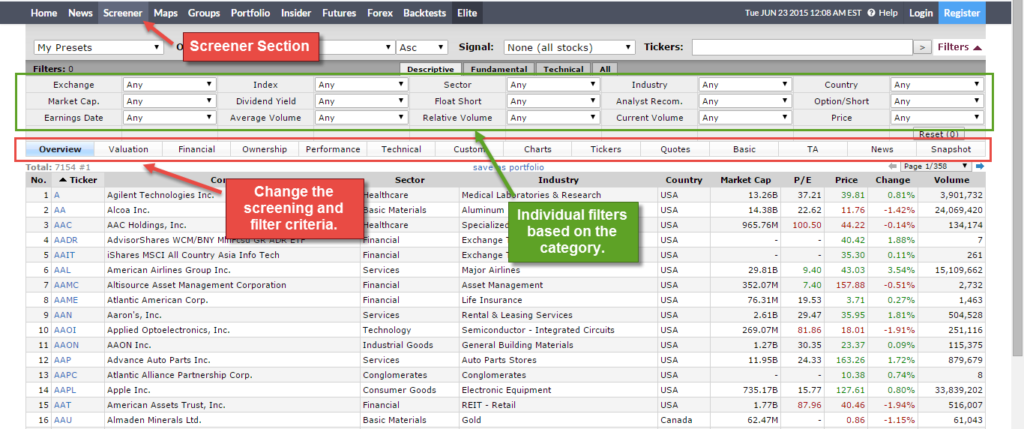

In simple terms, a stock screener is a digital tool that checks out a list of pre-determined stocks based on specific criteria. You determine which things you want the screener to look for in its database of stocks, and it will return a list of potential companies that you can invest in to improve your financial portfolio. Some stock screeners allow you to search for just a few basic things like volume, market cap and number of shares. Other screeners get much more in-depth with the information they provide, looking at things like Net Debt to EBITDA ratio and beyond. The best stock screeners also give you an option to save your searches, so you can come back to them later and check whether the price of individual stocks has moved up or down within a specific period. This is a great way to make informed decisions about your investments or make sure that you have a list of day-trade stocks to check out when you log into your accounts each morning.

What Can You Filter with Stock Screeners?

Stock screeners are all about filtering the choices you have in the current stock market, so you only focus your time and effort on the investments that are right for you. Of course, this means that the things you choose to filter will depend on the kind of trading you want to do. Most people look at things like market cap to determine which companies are too small for them to get involved with, and they also look at “price” to ensure that they’re not overspending on their assets. Once you get beyond those basic filters, things start to get a little more complicated. For instance, the PE ratio can help you to figure out whether your stock has potential for growth. The lower the PE ratio to the industry ratio, the better the value of the stock.

The critical thing to remember is that while stock screeners are useful to any trading strategy, they do have their limitations. Ultimately, these tools can only look at numbers, and you still need to think about other things like the reputation of the company, the product line, and the potential of the brand if you want to make sure that you’re choosing a stock that’s going to continue making you money five years from now.