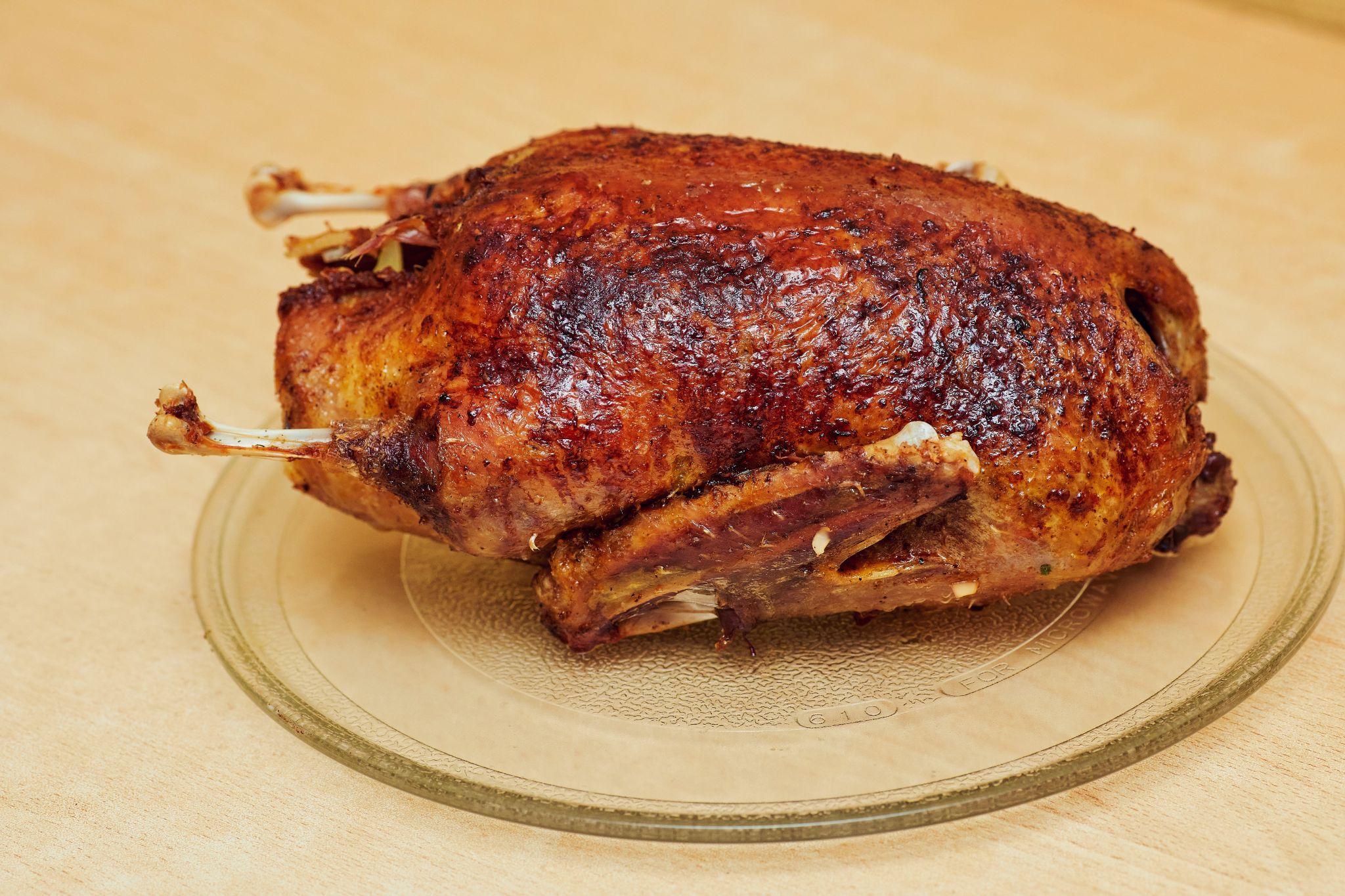

Duck meat is very different from the meat of any other poultry, such as chicken or turkey, familiar to any housewife, firstly, the color – it is not white, but pink, dark, and secondly, the taste – duck meat has a bright taste, which cannot be confused with any other. The meat of the duck, even not wild, but domestic, is very similar to game, so it needs to be cooked in a special way. Cooking duck requires diligence and skill from the hostess, but it is worth it. If you are going to bake a whole duck in the oven and stuff it with fruits or more complicated stuffing you will get a wonderful decoration for any table and a wonderful holiday dish.

Duck has been baked for centuries in different countries and at different times; it has been popular in Europe and in Asia as well. We all remember Baron Munchausen’s duck hunt from our childhood, and the famous “Peking duck” has been considered the calling card of Chinese cuisine for centuries. See details on Yagupov`s site by link. So let’s get down to business! Today we will tell you how to cook duck in the oven with apples, with oranges and in dough. We have tried to choose the proven best recipes for oven-baked duck.

Duck in the oven: cooking methods, principles

There are a lot of recipes for duck dishes, but most often they are different ways of cooking or stewed duck, or baked in the oven, in parts or whole. The composition of the stuffing, sauce, spices and marinade varies mostly. The stuffing can be very diverse: duck is stuffed with fruits: apples, oranges or quinces; cereals: rice or buckwheat, and often both; dried fruits: prunes, apricots and raisins are added. Sweet fruits and sauces go very well with duck meat, which has a specific taste, duck is often marinated in honey, sweet sauce or jam is served to it, it is stuffed with sweet porridge. We have prepared for you the best recipes for duck baked in the oven, so you can appreciate the dishes that have been admired for centuries in different parts of the world, and enjoy their exquisite taste.

Preliminary preparation: an important and necessary step in the preparation of duck

First of all, the duck should be well washed, dried and made sure that it is completely plucked. If there are any feathers or hair “stumps” in the skin, they should definitely be removed, plucked, and if not, they can be trimmed together with the skin. Most often feather particles remain in the tail part of the bird, that is where the glands are, from which just comes the smell of “game”, from which we need to get rid of in the first place.

When heat treating, the smell intensifies, if you can not remove the hair follicles, it is better to cut off the tail. Next, before cooking duck in the oven, the bird should be marinated. The marinade can vary – some use wine or lemon juice and, of course, spices. Some people prefer a sweet marinade, letting the duck rest in honey and ginger before cooking, so that the meat becomes softer, juicier and infused with a delicate and spicy flavor.

Let’s look at the best recipes for oven-baked duck.

Recipe 1: Duck in the oven with oranges

How to cook duck in the oven with oranges? The alternative to the popular duck with apples is very worthy and even more refined and interesting. Oranges, just like apples, contain a sour-sweet juice that marinates the duck from the inside out. The fruit gives the acid to the meat, absorbs the meat juice and neutralizes the fat, making the baked duck more tender and juicy.

So if you’re pondering how to roast duck in the oven in a new way, but at the same time not too much deviation from the classic recipe, this dish is for you. Oranges will add a light tropical touch to your favorite dish recipe, but overall you’ll get a familiar holiday treat.

Ingredients for the dish

- Duck carcass (young) – 2 to 2,5 kg;

- Celery (green stalks) – 2-3 pcs;

- Orange – 1 – 2 pcs.

Ingredients for the glaze

- Orange (juice) – 1 pc;

- Wine (sweet, dessert) – 2 tablespoons;

- Honey – 2 tablespoons.

Ingredients for the marinade

- Orange (juice) – 1 pc;

- Lemon (juice) – 1 pc;

- Salt – 1 tbsp;

- Oil (lean) – 1 tbsp;

- Black pepper – ½ tbsp;

- Provençal herbs – ½ tbsp;

- Sage (dried) – 1 teaspoon.

Method of cooking

We take the duck, cut off unnecessary fat, remove skin – the neck and the tail part, we will not need them. Also we carefully cut off a tip of a wing-edge joint, as it is too thin and can burn up very quickly. Rinse the duck well, if there is anything left of the giblets – remove and rinse thoroughly, they can give an unpleasant taste and smell. Wipe it dry. Prepare the marinade- squeeze out the juice of orange and lemon, add the rest of the ingredients and mix. Spread marinade on duck, cover with cling film or lid and send in cold. Before you bake the duck in the oven, give it a good marinade, leave it for a day or at least overnight in the refrigerator.

Now prepare the mold. The form should have high sides, otherwise the juice can leak out. Before you bake the duck in the oven, grease the form with oil and put the marinaded bird on it with the belly up. Cut the orange slices and stuff the duck with them. Add the celery. Green celery petioles are very useful, they contain many vitamins, but not everyone may like them, in which case carrots or apples can come into play instead of celery. Place the duck in the oven and bake for 2 to 2.5 hours at 190°C (374°F). In the middle of the process, an hour from the start of baking, open the oven and every 15 minutes sprinkle the duck with its own juice, gently scooping it out of the mold.

Prepare the glaze. We squeeze the orange juice, add honey and wine, and cook, stirring gently. The mass should be boiled. You will see that it will be half the size and much thicker. Ideally, it will be as thick as syrup.

Take out the duck, already cooked. Let it cool a bit, take out the stuffing – you can remove the celery if it is not to your liking, lay the fruit nicely around our duck and pour the glaze over it.

Recipe 2: Duck baked with apples in a sleeve

How to cook duck baked with apples? Housewives are often afraid of over-drying the meat when baking, so if you’re worried about how to cook your duck in the oven so that it turns out soft and juicy, this recipe is for you. Pack the duck in a baking sleeve, and it will definitely not dry out, because it will practically stew in its own juice in the sleeve.

The sleeve is almost airtight, and all the fat and juice will stay inside, creating a steam bath. This has another little bonus for the hostess – it is easier and easier to wash the tray after cooking duck in the sleeve, as well as the oven itself – the sleeve will protect it from contamination, as anything that might splatter will splatter in the sleeve, which you will then safely throw away.

Ingredients for the dish

- Duck carcass (small) – 1.5 to 2 kg;

- Green apples – 2 to 3 pcs;

- Salt – “by eye”, as much as you need to rub the duck with it;

- Black pepper – as well as salt, to taste.

Ingredients for marinade

- Lemon (juice) – 1 pc;

- Lean oil – 1 tbsp;

- Honey – 1 tbsp;

- Ginger root – 1 piece (or garlic – 2-3 cloves if you do not like ginger);

- Balsamic vinegar – 1 teaspoon (optional).

Method of cooking

Remember the golden rule: before cooking duck in the oven, it must be marinated and sent into the cold – overnight or 24 hours. So first we make a marinade. We squeeze the juice of a lemon, finely grate the ginger root (or, if you do not like ginger – garlic, but do not combine them together, they both have a bright taste and can “argue” in the dish). Add the rest of the ingredients and stir.

Wash the duck well, remove all excess, wipe almost dry and rub with salt and pepper, inside and outside. We put the bird in the marinade overnight or for 24 hours (12 or 24 hours).

Before baking the duck in the oven, we take the apples, cut out the cores, cut into halves – if the apples are small, if large – quarters or smaller, look at the situation, and stuff the carcass with them. You can fasten the skin with toothpicks or even sew it up to prevent the apples from falling out. We wrap the duck in the sleeve and send it to the oven for an hour and a half. Bake at 190°C (374°F). About 10-15 minutes before the finale, when the duck is almost done, cut the sleeve from the top so the duck is browned and crispy. It is considered a great skill, a special chic, how to cook duck in the oven so that the meat is juicy and the skin is crispy. But in fact it is not so difficult, so the best recipes for baked in the oven duck are able to be recreated in your kitchen any, not even the most experienced hostess.

Before serving, remove the toothpicks or strings (do not forget about them!) and pour the juice over it. As a side dish you can prepare mashed potatoes or potatoes baked in the oven with rosemary, for example – it adds a sweetish flavor to potatoes and goes well with duck meat. You can use lingonberry jam as a sauce. If you made it with garlic and not with ginger, then the sweet sauce will be superfluous, and served with pickles.